Table of Contents

- Introduction

- The Key Idea

- Simple Example: Family → State

- Real Government Numbers

- Why Inflation Helps the State

- Why This Is NOT Coincidence

- Where Stablecoins and CBDCs Come In

- Is Inflation "Raising Living Standards"?

- The Moral Paradox

- Ultra-Clear Summary

- Koinonos' Response: An Ethical Stablecoin

- Principles of an Ethical Stablecoin

- Recommended Architecture

- Operational Ethics Checklist

- Conclusion

Introduction

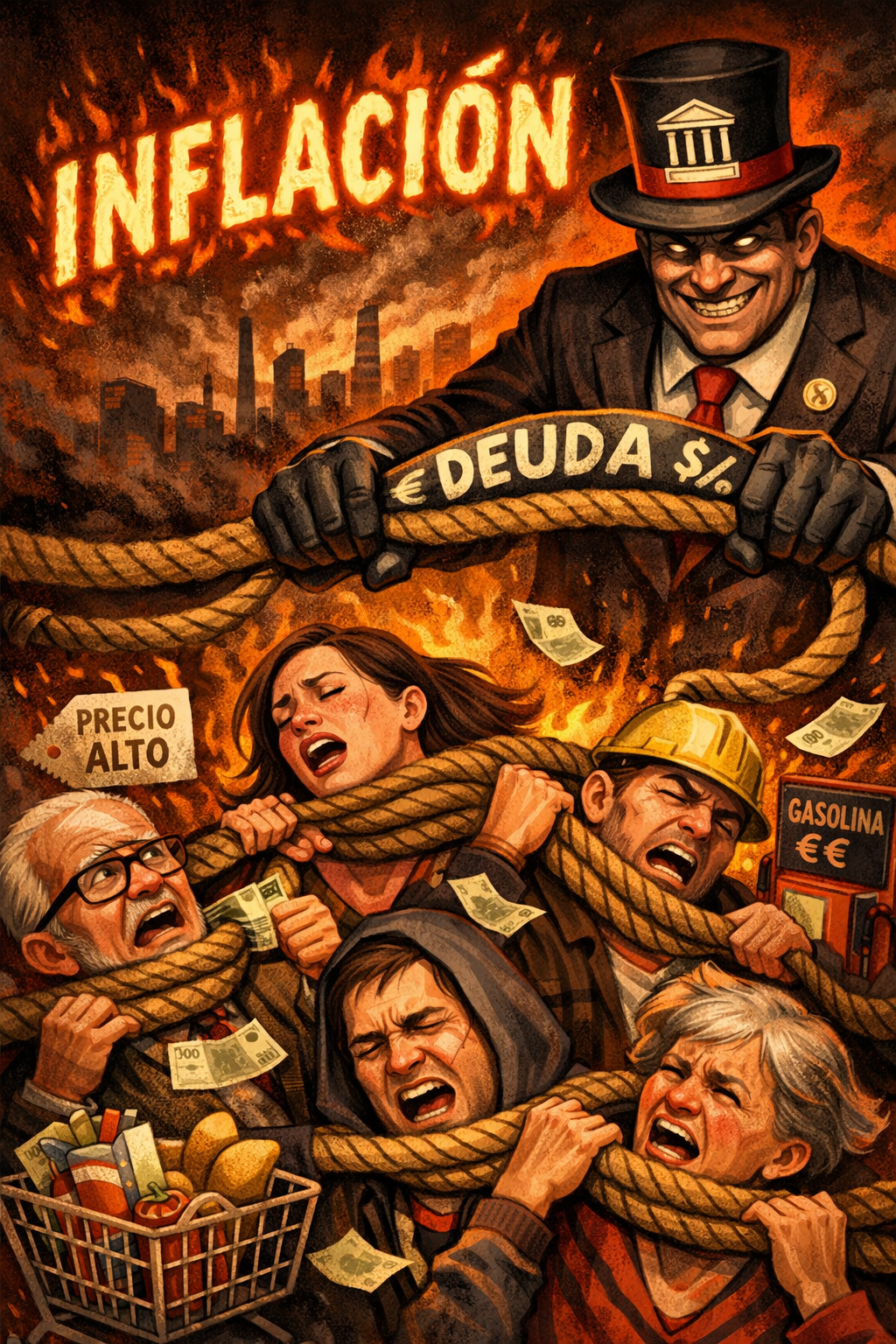

We live in an era where money constantly loses value, states accumulate record debt, and the average citizen feels that although "the economy is growing," their standard of living is deteriorating. Coincidence? No. It's a deliberate and silent mechanism that has been operating for decades.

In this article, we'll explain:

- How inflation reduces public debt without the state paying a single euro

- Why governments need inflation to survive

- How stablecoins and CBDCs can amplify control

- What an ethical stablecoin is and why Koinonos wants to build one

1️⃣ The Key Idea (in One Sentence)

💡 Core Concept

Inflation reduces the real value of public debt because that debt is expressed in nominal money, not purchasing power.

Simply put: The state repays the same number of euros, but those euros are worth less.

2️⃣ Simple Example: From Family to State

Imagine that:

- You take out a €100,000 mortgage

- Your salary is €2,000/month

Now, over 10 years, due to inflation:

- Your salary rises to €3,000/month

- The price of everything goes up

- But the debt remains €100,000

📉 Result

The debt "weighs less" on your life

A state does the same thing. The nominal debt doesn't change, but GDP (the country's "salary") rises with inflation.

3️⃣ Example with Real Government Numbers

Let's suppose:

- Public debt: €1 trillion

- GDP: €1 trillion

- Debt/GDP ratio = 100%

Now there's 5% annual inflation for 5 years (simplified):

Debt Erosion Through Inflation

| Year | Nominal GDP | Debt | Debt/GDP Ratio |

|---|---|---|---|

| 0 | €1,000,000 M | €1,000,000 M | 100% |

| 5 | €1,276,000 M | €1,000,000 M | ≈ 78% |

📉 Key Insight

Without paying debt, just letting inflation do its work, the debt/GDP ratio drops from 100% to 78%.

4️⃣ Why Inflation Helps the State

🔹 1. Taxes Rise Automatically

- VAT, income tax, social security contributions → rise with prices and wages

- The state collects more without officially raising rates

- This is called the inflation tax (but almost nobody calls it that)

🔹 2. Debt Is "Frozen"

Most public debt:

- Is issued long-term

- At fixed rates

- Doesn't automatically adjust to inflation

💡 Analogy

Inflation = debt blender

🔹 3. Citizens' Savings Lose Value

- Money in accounts: loses purchasing power

- The state: benefits indirectly

📌 Silent Wealth Transfer

This is a silent transfer of wealth: from saver → to debtor (the state)

5️⃣ Why This Is NOT Coincidence

Historically, after:

- Wars

- Massive crises

- Pandemics

States have always used inflation to:

- Reduce debt

- Avoid sovereign bankruptcies

- Buy political time

📖 Historical Examples:

- USA after World War II

- Europe in the 1970s

- Post-2008 period

- Post-COVID period

6️⃣ Where Stablecoins and CBDCs Come In

This is where things get interesting (and concerning).

🔸 Programmable Money

State stablecoins / CBDCs allow knowing:

- Who spends

- When

- On what

- Where

🔸 Control of Money Velocity

A government could:

- ✅ Incentivize spending

- ❌ Penalize saving

- ⏰ Put expiration dates on money

- 🚫 Limit certain uses

⚠️ The Perfect Storm

Inflation + programmable money = very fine control

This combination gives governments unprecedented power over citizens' financial behavior.

7️⃣ So… Is Inflation "Raising Living Standards"?

❌ Not exactly.

Inflation:

- ✅ Raises prices

- ❌ Doesn't guarantee wages rise equally

- 📉 Reduces the real value of savings

That's why:

- Citizens feel they're "living worse"

- Even though "the economy is growing" in numbers

8️⃣ The Moral Paradox

The system needs inflation to survive, but:

- ❌ Punishes the prudent (those who save)

- ✅ Benefits the:

- Indebted

- Money issuer

- State

💡 Why This Matters

That's why projects like Koinonos, well-designed and ethical, are dangerous to the status quo.

9️⃣ Ultra-Clear Summary

Key Takeaways

- ✔ Inflation reduces public debt

- ✔ Increases tax revenue without visibly raising taxes

- ✔ Dilutes the population's savings

- ✔ Is a silent political tool

- ✔ Stablecoins/CBDCs can amplify control

- ✔ Citizens pay the cost without voting on it

🔟 Koinonos' Response: An Ethical Stablecoin

Do We Have the Perfect Solution?

No. We'd be dishonest if we said yes.

But we do believe it can be done better.

What Is an Ethical Stablecoin?

It's NOT "one that can't be controlled" (that depends on design and legal framework).

✅ An Ethical Stablecoin Is One That:

- ❌ Minimizes abuse, surveillance, and capture

- ✅ Maximizes transparency, user rights, resilience, and accountability

Principles of an Ethical Stablecoin

1️⃣ Privacy by Design (Without Being "For Crimes")

- No mass surveillance "by default"

- Selective and proportional compliance:

- KYC/AML where it matters (fiat on/off-ramps, limits)

- Not for every coffee purchase

- Support cryptographic proofs (ZK) to demonstrate:

- "I'm not sanctioned"

- "I don't exceed limits"

- "Lawful origin"

- Without revealing your entire identity and history

2️⃣ Minimal Censorship with Due Process

- No arbitrary "freeze" by an operator just because

- If there's freezing/blacklisting, it should be:

- ⚖️ With legal order + public traceability of reason (at least metadata)

- ⏰ Time-limited

- 📝 Appeal mechanism

- 🔍 Independent audit

3️⃣ Radical Transparency of Reserves and Risks

Frequent proof (ideally: daily) of:

- 💰 Reserves

- 🏦 Custody (where they are)

- 📊 Composition (cash, T-bills, repos…)

- 📈 Duration/interest rate risk

External audits + SOC/ISAE-type reports when applicable.

Publish a risk policy: what can be purchased with reserves and what cannot.

4️⃣ Credible Governance

An issuer with rules that don't change on a whim:

- 📜 Bylaws, risk committee, internal controls

- 🔐 Multi-signature / multi-party control

- 👥 Board with independent members

If there are contract upgrades:

- ⏱️ Timelock

- 🗳️ Voting (if applicable)

- 🚨 Emergency break glass very limited

5️⃣ Design That Doesn't Punish the User

- Clear parity (1:1) and guaranteed fast redemption

- Predictable fees

- No "money expiration" or spending restrictions except by specific legal mandate

6️⃣ Access and Inclusion

"Light" modes:

- Small balances with simplified KYC (if regulation permits)

- Limits by tier

Support for non-custodial wallets

Recommended Architecture (3 Layers)

Layer A: Issuance and Reserves (off-chain)

- Regulated issuer (ideally EMI if in Europe, or equivalent structure)

- Segregated accounts, first-tier custody

- 100% collateralized policy in ultra-liquid assets (cash + short-term T-bills)

Layer B: Token and Compliance (on-chain)

- "Simple" contract (mint/burn/transfer)

- Modular compliance:

- Rules at entry/exit (fiat ramps)

- On-chain, the minimum necessary (sanctions lists, risk-based limits)

- Avoiding "panopticon"

Layer C: Verifiable Privacy (ZK)

For everyday payments:

- "Proof of compliance" without revealing complete identity

- This is what makes it ethical: you comply with rules without turning the system into a total surveillance tool

Operational Ethics Checklist (Concrete Things)

Implementation Requirements

- ✅ User Bill of Rights (public): What data you collect, when you freeze, how to appeal

- ✅ Event transparency: Every freeze/unfreeze generates a public event (even with coded reason)

- ✅ Anti-abuse policy: No selling data, no profiling for advertising, data minimization

- ✅ Redemption: Redemption SLA (e.g., T+0/T+1), and visible queues if there's stress

- ✅ Resilience: Contingency plan (multiple banks, redundant custody, audits)

Conclusion

Inflation is not an accident. It's a political tool that:

- Reduces public debt

- Increases tax collection

- Punishes savers

And with the arrival of CBDCs and programmable stablecoins, control can become total.

🎯 Koinonos' Commitment

Koinonos doesn't have the perfect solution, but we believe it's possible to build a stablecoin that:

- ✅ Complies with European legislation

- ✅ Respects user privacy

- ✅ Is transparent in reserves and governance

- ✅ Minimizes abuse and mass surveillance

It's not utopia. It's engineering, ethics, and commitment.

Want to Be Part of This Change?

Follow us on our journey to build a stablecoin that respects your rights.

Learn More About KoinonosDisclaimer: This article is for informational and educational purposes only. It does not constitute financial, legal, or investment advice. The views expressed are those of Koinonos and represent our commitment to building ethical financial infrastructure.